Futures contracts for commodities allow buyers and sellers to agree on a future date and price they will trade. Companies and investors often utilize them to protect themselves from the risk of commodity price changes. When hedging using commodity futures, investors and businesses must determine which commodity to defend themselves from. They commit to purchasing or selling the item at a future date and price through a futures contract. Farmers may use a futures contract to sell their crops at a predetermined price to guarantee a stable income independent of market volatility. A manufacturer may utilize a futures contract to secure a regular price for an essential commodity, such as oil or steel, and hedge against potential price rises.

Step-By-Step Guide To Commodity Futures Hedging

Identify The Underlying Commodity And The Size Of The Exposure

Identifying the underlying commodity and the magnitude of the exposure is the first stage in hedging with commodity futures. To hedge gold price risk, a jewelry producer, for instance, must forecast how much gold will be required for manufacturing over a given period. The magnitude of the exposure the manufacturer needs to hedge can then be estimated.

Determine The Appropriate Futures Contract

Finding the proper futures contract for hedging purposes is the next step. The exposure to be hedged must be matched with a futures contract's appropriate size and parameters. One of the most common gold futures contracts is issued by the CME Group and is equal to 100 troy ounces of gold, whereas one silver futures contract equals 5,000 troy ounces of silver.

Choose The Hedging Strategy

- After settling on the proper futures contract, the next step is to decide on a hedging technique. Hedging can be done in two primary ways: long or short.

- When a hedger has a long position in the underlying commodity but is concerned about a potential price drop, it may employ long hedging. To ensure a steady commodity price, the hedger here purchases futures contracts.

- When the hedger holds a short position in the underlying commodity and wishes to protect against a price rise, it may employ short hedging. The hedger here is selling futures contracts to guarantee a specific commodity price.

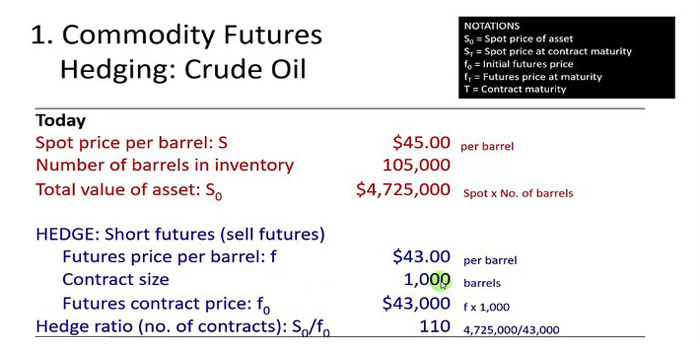

Calculate The Hedging Proportion

The hedge ratio measures the proportion of the hedged exposure to the amount of the futures position. The balance is determined by dividing the direction and futures contract sizes. The hedge ratio determines the number of futures contracts the hedger must buy or sell to offset their risk adequately.

Keep An Eye On The Market And Tweak The Hedge

After the hedge, monitoring the market and making any required adjustments is crucial. If the commodity's price goes opposite, the hedger may need to acquire or sell additional futures contracts to keep the wall in place.

Advantages Of Commodity Futures Hedging

Price Stability

Hedging using commodities futures offers price stability, its key benefit. The hedger can safeguard themselves from price volatility and guarantee a stable production cost by fixing a price for the underlying commodity.

Risk Management

Hedging with commodity futures is an efficient way for individuals and businesses to deal with price volatility. They can hedge against price swings and lessen their sensitivity to market swings.

Liquidity

Hedge funds and other speculators can quickly enter and exit commodity futures markets due to their high liquidity. This facilitates effective risk management through flexible hedge adjustments.

Conclusion

Producers, manufacturers, and investors all use commodity futures to hedge their bets. Hedging with commodity futures requires familiarity with hedging theory, the correlation between spot and futures prices, and the mechanics of futures trading. To hedge with commodity futures, one must take a position in the futures market opposite the one in the cash market. Locking in a future price at today's prices protects against the risk of adverse price swings in the cash market. To protect themselves from a drop in maize prices, farmers may choose to sell corn futures contracts. To use them efficiently, one must be aware of the costs associated with commodity futures hedging, including margin requirements, brokerage fees, and bid-ask spreads. One must also be willing to closely monitor the markets and adjust the hedging plan as needed.