Do you ever take a moment to step back and contemplate the concept of accumulated value? The idea is quite abstract, yet critical for understanding how many aspects of our lives develop. Whether you're speaking about finances, relationships, organizational behavior, or personal growth: accumulated value matters.

It shapes how we move forward both now and into the future. In this blog post, let's dive deep into what makes up accumulated value and how it can affect your life in more ways than one.

What is accumulated value, and what are its benefits for homeowners and investors?

Accumulated value, also called accumulated equity, is the total increase in one's home or property's value over time. Accumulated value can be used in two ways: either the homeowners can withdraw from it during certain life events such as retirement or college tuition payments, or investors can use this extra benefit to secure an additional return on their investment when selling the property.

For homeowners, the accumulated value is a great source of extra funds that can be used for various needs. The most common use of this equity is to finance college tuition fees, retirement costs, or other financial obligations that arise in life. Homeowners may also use this accumulated value to purchase a second home or take out a loan.

For investors, the accumulated value is an excellent source of additional investment return. As the property increases in value over time, investors can sell it for a larger sum than its original purchase price. This represents a great opportunity to increase one's return on investment, especially in the current market, where real estate value is expected to continue increasing.

How can you calculate the accumulated value of your home or investment property portfolio, and what factors influence the calculation process?

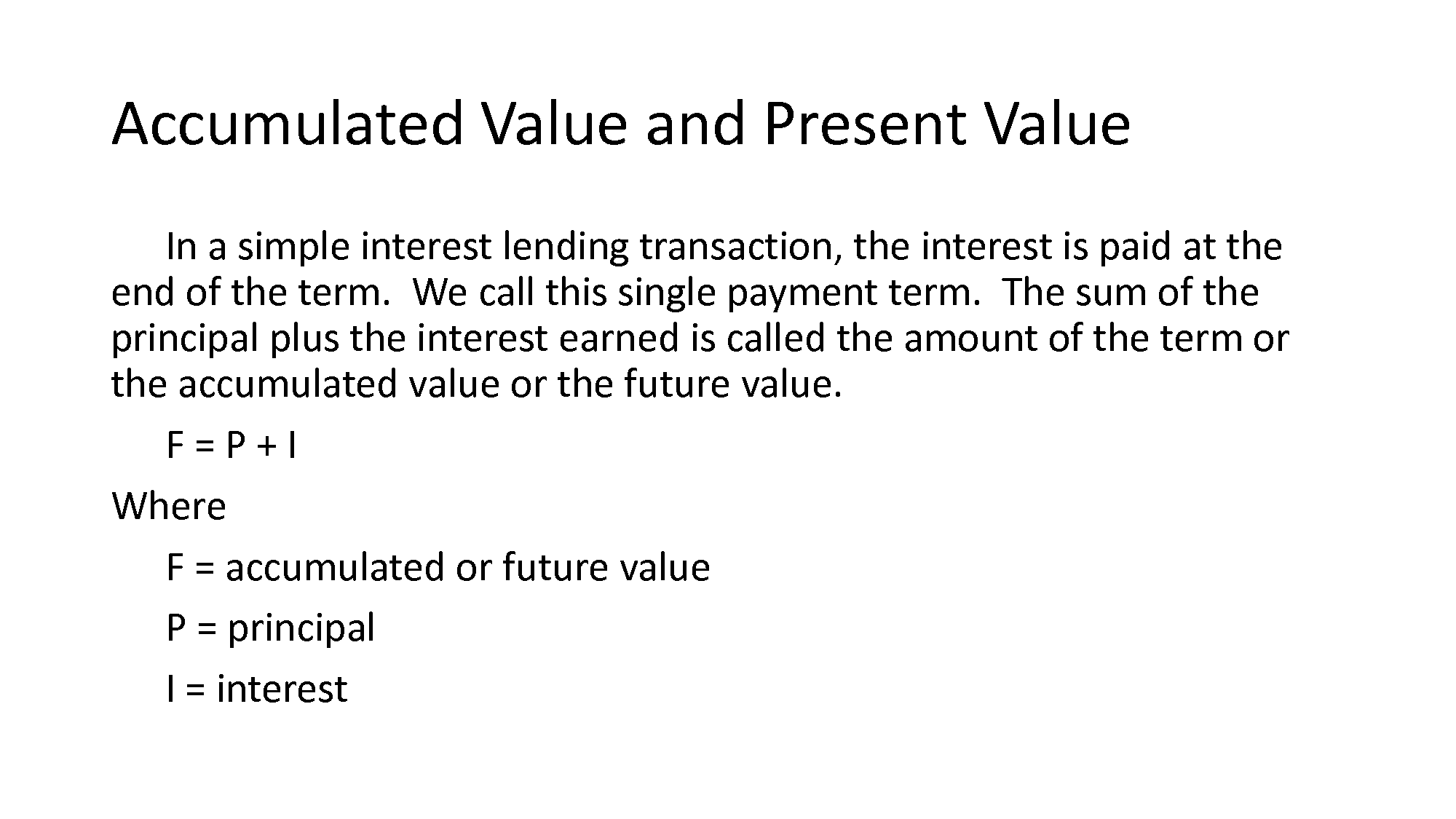

The accumulated value is a term used to describe the total value of an asset over time, taking into account all associated capital gains and losses.

Calculating the accumulated value of your home or investment property portfolio can be done by subtracting all costs associated with acquiring and maintaining the properties from their current market values. These costs may include loan repayments, maintenance fees, insurance premiums, and taxes.

It's important to remember that the accumulated value of an asset will also be impacted by any external economic factors which could affect its overall value. Factors such as changes in interest rates, local property markets, and government regulations can greatly impact your portfolio's cumulative growth.

By tracking your portfolio's accumulated value, you can better understand its worth and what potential returns you could expect from investing in additional properties. Knowing these factors will help you make more informed decisions about your investments.

What are key things to remember when maximizing your accumulated value through strategic investments and sound property management practices?

The accumulated value is the overall net worth of an investment property. It's important to remember that each investment property has unique characteristics and therefore requires a tailored approach to maximizing the potential return. Here are some key considerations when looking to maximize your accumulated value:

1. Long-term vision: have a plan that outlines how you will achieve your goals over the long term. This includes researching the local market, understanding trends, and developing a strategy to acquire assets that yield the best returns.

2. Strategic investments: make sure to invest wisely and calculate any potential future costs or repairs associated with owning an investment property. Also, consider the risks associated with any investments to ensure your decisions are sound.

3. Property management: effective property management practices can also help maximize the accumulated value of an investment property. This includes maintaining maintenance, ensuring all paperwork is in order and staying on top of tenant needs and complaints.

By following these key considerations, you can ensure that your investments can provide the highest possible accumulated value and return on investment.

Case studies of how accumulated value has benefited homeowners and investors in different markets around Australia.

Accumulated value has been a beneficial tool to many homeowners and investors in different markets around Australia. The accumulated value is the equity growth in an asset over time, usually resulting from the appreciation of property values or improvements made to the asset.

Case studies of how accumulated value has benefited homeowners and investors include:

In Sydney, a homeowner bought a unit in 2005 for $360,000 and sold it in 2017 with an accumulated value of its original purchase price of $750,000.

In Perth, an investor purchased an apartment complex in 2018 for $1.2 million. With the power of accumulated value, they could on-sell the complex in 2019 for $1.7 million.

In Melbourne, an investor purchased a multi-unit property in 2012 for $650,000 and sold the same property in 2017 with an accumulated value of its original purchase price of $850,000.

By understanding and leveraging accumulated value, homeowners and investors have significantly increased the profitability of their investments in different markets around Australia. Furthermore, the accumulated value is a great tool for buyers to use when making an offer on a property. It can increase the likelihood of having that offer accepted by demonstrating additional future potential.

The future of accumulated value – what trends are on the horizon that could impact this important metric?

The accumulated value is an important metric for businesses of all sizes, and understanding how it works and analyzing its performance can help you better manage your investments. As technology advances, how we measure accumulated value may change to keep up with current trends. Here are some of the key trends that could impact this metric in the future:

- Increased use of digital assets. As more companies transition to a digital workflow, they will need reliable metrics to measure and track their investments. The accumulated value is an ideal tool for analyzing digital asset performance, as it measures both short-term and long-term growth.

- Improved data analysis tools. Accumulated value depends on accurate and organized data to make informed decisions, so having access to the most up-to-date data sets will be increasingly important. Improved data analysis tools can help businesses better understand how their investments are performing and give them an edge in the market.

- Automation technology. Automation can streamline the process of tracking accumulated value, eliminating manual data entry and making calculations faster and more accurate. Automation technology can also analyze large datasets to provide deeper insights into an investment's performance over time.

FAQs

What Is Accumulated Value?

The accumulated value measures the total amount an investment has gained over time. It considers the initial principal and all the subsequent returns and capital appreciation associated with the investment. The accumulated value of an asset can be used to compare different investments and evaluate their relative performance.

What Factors Influence the Accumulated Value?

The accumulated value of an asset is largely determined by factors such as the initial investment amount, the rate of return on the investment, and the length of time it has been held. The performance of other investments in comparison to one's own also influences accumulated value, as investors may choose to switch investments if another asset is appreciating faster than their own.

What Are The Benefits Of Tracking Accumulated Value?

By tracking an investment's accumulated value, investors can better identify trends and make informed decisions about their investments. This can help them maximize profits and minimize losses, as well as allow them to keep tabs on the performance of different investments compared to one another.

What Are Some Examples Of Accumulated Value?

The most common example of accumulated value is the retirement savings account. These accounts generally accumulate money over time as contributions are made and invested, leading to a larger principal and higher returns than if the same amount had been left in a regular savings account. Examples include mutual funds, stocks, bonds, and real estate investments.

Conclusion

This article has given you a better understanding of the accumulated value and how it can be used in retirement planning. Accumulated value can help you plan for the future, secure your financial security, and meet any other goals you may have for your retirement.

With careful planning and monitoring of investments, accumulating value can provide a secure financial foundation for the long term. Remember, the key to successful retirement planning is understanding what accumulated value is and how it can work for you.