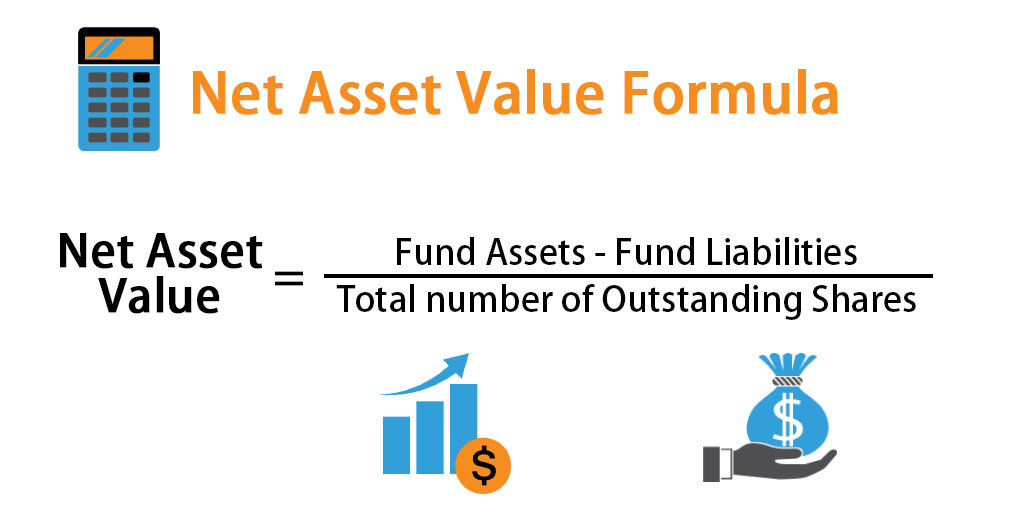

Values per share of a mutual fund, exchange-traded fund or closed-end fund are the net asset value per share This is an expression of net asset value that indicates the value per share of a fund. The formula for calculating it is to divide the net asset value of the fund or corporation by dividing it by the total number of currently circulating shares. In some circles, it is also called book value per share.

Understanding The Net Asset Value Assigned to Each Share (NAV)

The worth of a fund, as measured by its net asset value (NAV), is calculated by deducting its obligations from its assets. Costs, including short- and long-term loans, employee pay, and administrative expenditures, are included in the category of liabilities. Invested securities, cash on hand, and customer receivables are examples of assets. A fund's net asset value per share is determined by using the fund's NAV as the basis for the calculation. The Net Asset Value Per Share, or NAVPS, measures a fund's value that considers each share's value.

How Exactly Does the NAVPS Work?

Because mutual fund shares only trade once a day, the NAVPS operates in a manner analogous to that of stock prices. Generally, the NAV, plus or minus fees, is the price at which shares in mutual funds trade. Daily after the market closes, they are obliged to compute their NAV to keep up with the regularly shifting values of their assets, liabilities, and excellent shares.

The way that ETFs and closed-end funds operate is rather distinct from one another. In contrast to mutual funds, these assets move like stocks throughout the day rather than all at once at the end of the day. This indicates that their market price and NAV may move differently. Consequently, these funds often update their NAVs while the markets are open, with a final daily NAV being determined after the markets have closed.

NAV Per Share: How To Figure It Out

A mutual fund manager must determine the fund's net asset value per share during each accounting period. They must disclose material facts, such as the mutual fund's assets, liabilities, and costs. The NAVPS may be computed by following these steps:

Step 1 : determine whether you made a profit or lost money based on the item's current market value and the applicable exchange rates.

Step 2: Add up all the fund's obligations and liabilities, including short- and long-term interest and fees.

Step 3: Account for the provision in the accounting period for the fund's expenses (to apportion the costs to the different net asset value periods). Audit fees, administrative fees, taxes, and miscellaneous operational expenditures might all be included.

Step 4: determine the per-share net asset value.

Importance Of Net Asset Value Per Share

Because it reflects the value of one share of the mutual fund and an exchange-traded fund the net asset value serves a purpose that is analogous to that of the stock price. When evaluating the performance of a mutual fund relative to the market or industry benchmarks, the NAVPS can be utilized as a comparative tool.

However, analysts claim that evaluating short-term changes inside the NAVPs is more productive than analyzing long-term changes. This is because most funds regularly transfer capital gains and profits to owners.

On the different hand, one of the limitations of NAVPS is that its daily price changes as a result of the forces of the market, in addition to the expenditures of the fund, which come about in due time. Because the NAVPS for mutual funds is only computed once a day, at the end of the trading day, when the market is closed, shareholders cannot ascertain the value of their shares throughout the trading day.

That is a disadvantage for mutual funds in general, and exchange-traded funds are preferable in situations like this one.

Constraints Included Within the Use Of Net Asset Value Per Share – NAVPS

In the context of the corporate financial statements of publicly listed corporations, the net asset value per share (NAVPS), also known as the book value per share, is often lower than the market price per share. The historical cost accounting concept, which has the propensity to underestimate the value of some assets, as well as the supply and demand pressures of the market, typically result in stock prices that are higher than the book value per share valuations of the company.